ev tax credit 2022 rivian

EV Tax Credits Tesla Lucid Rivian VinFast. Can I claim the EV tax credit for two cars in the same year 2022.

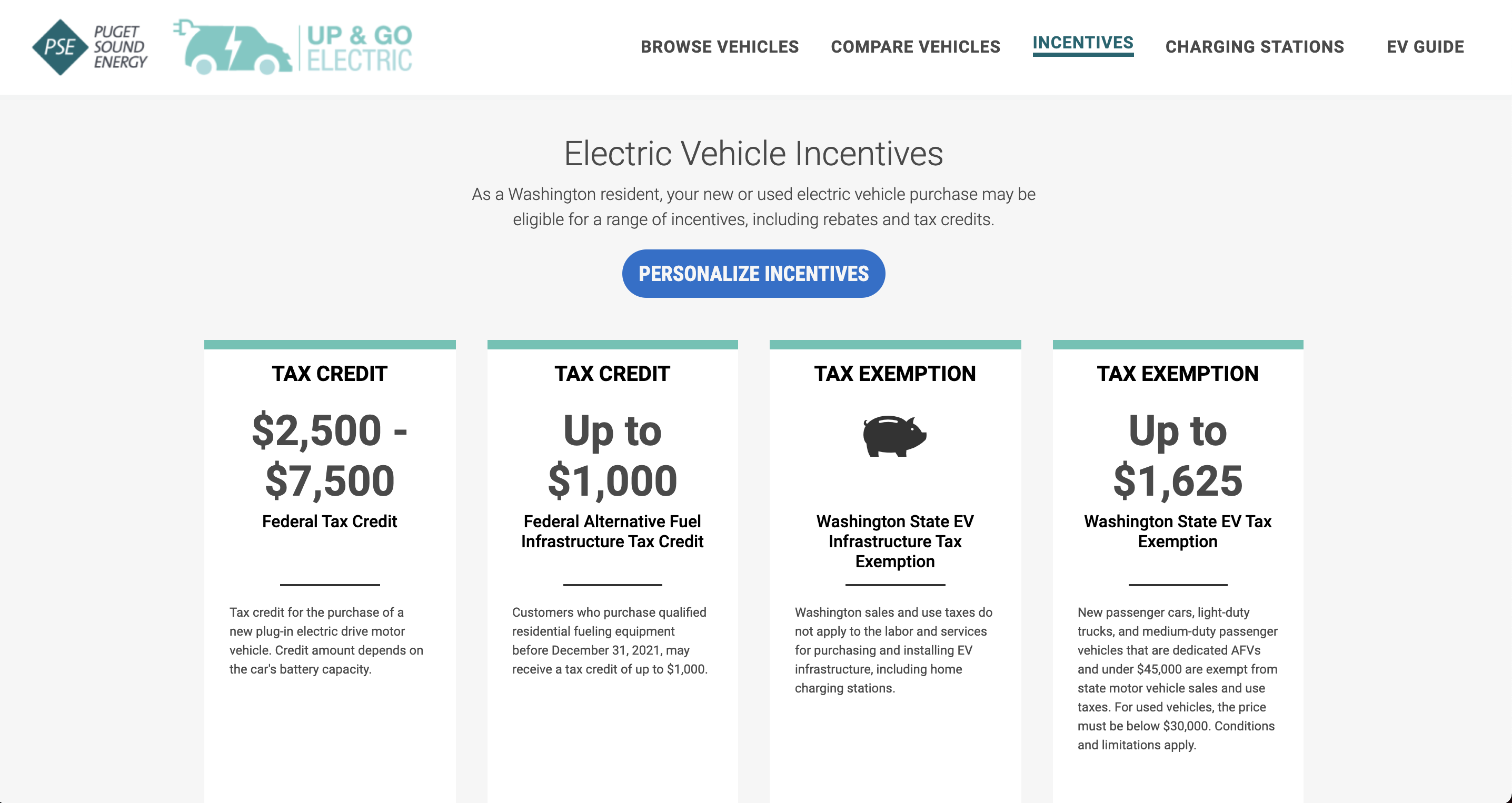

The maximum tax credit allowed for each eligible vehicle is 7500 for the 2022 calendar year.

. If the vehicle qualifies you can receive anywhere from 2500 all the way up to 7500. Check out the updated video with questions answered https youtube HYJ96Y2-K6gThe new EV Tax Credit legislation will benefit Ford GM and Tesla in a big w. If you need vehicle service you can report vehicle.

United States You may be eligible for federal state or local incentives subject to applicable incentive terms and conditions Federal Incentives The United States offers an electric vehicle. The 7500 tax credit. New Cars New.

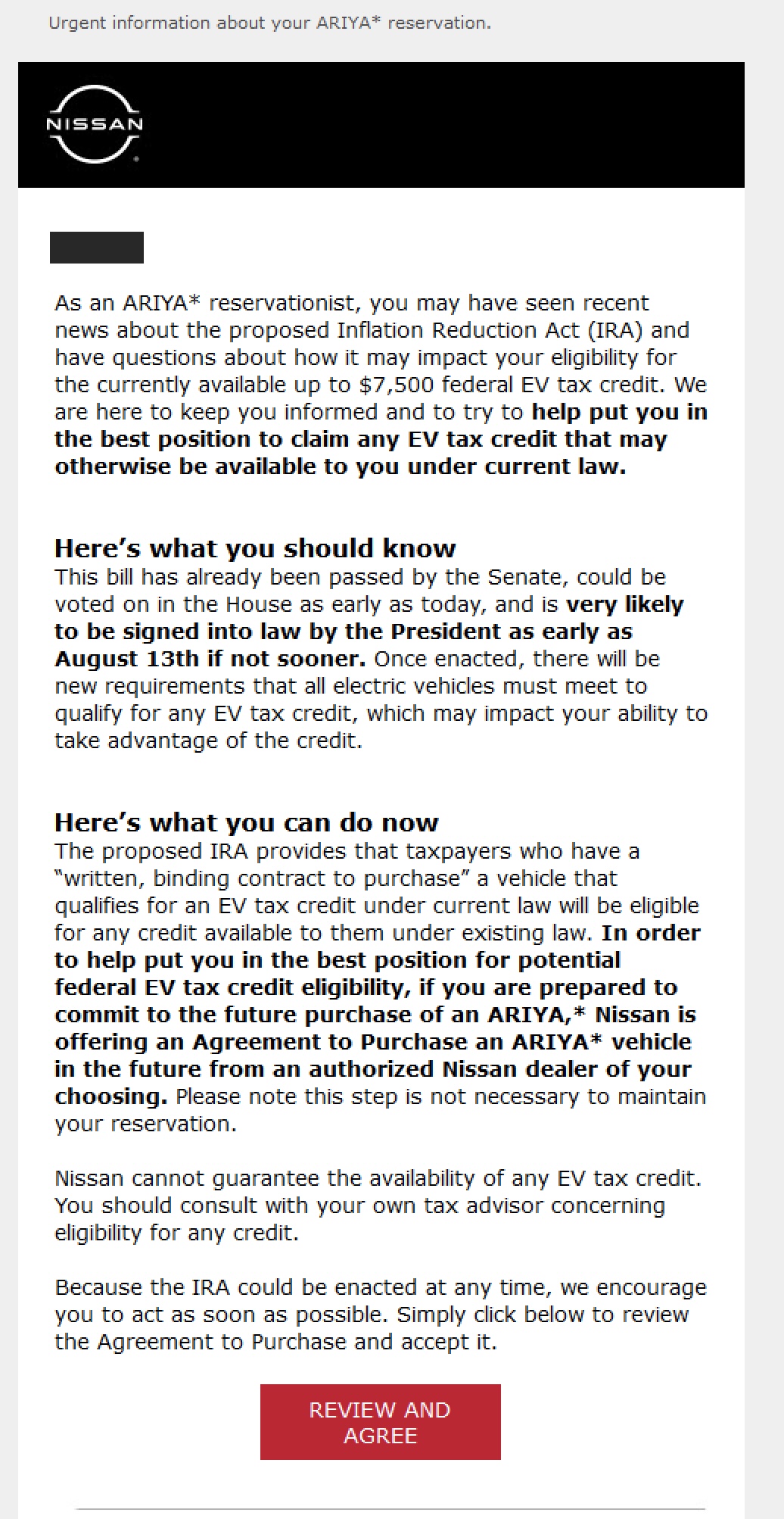

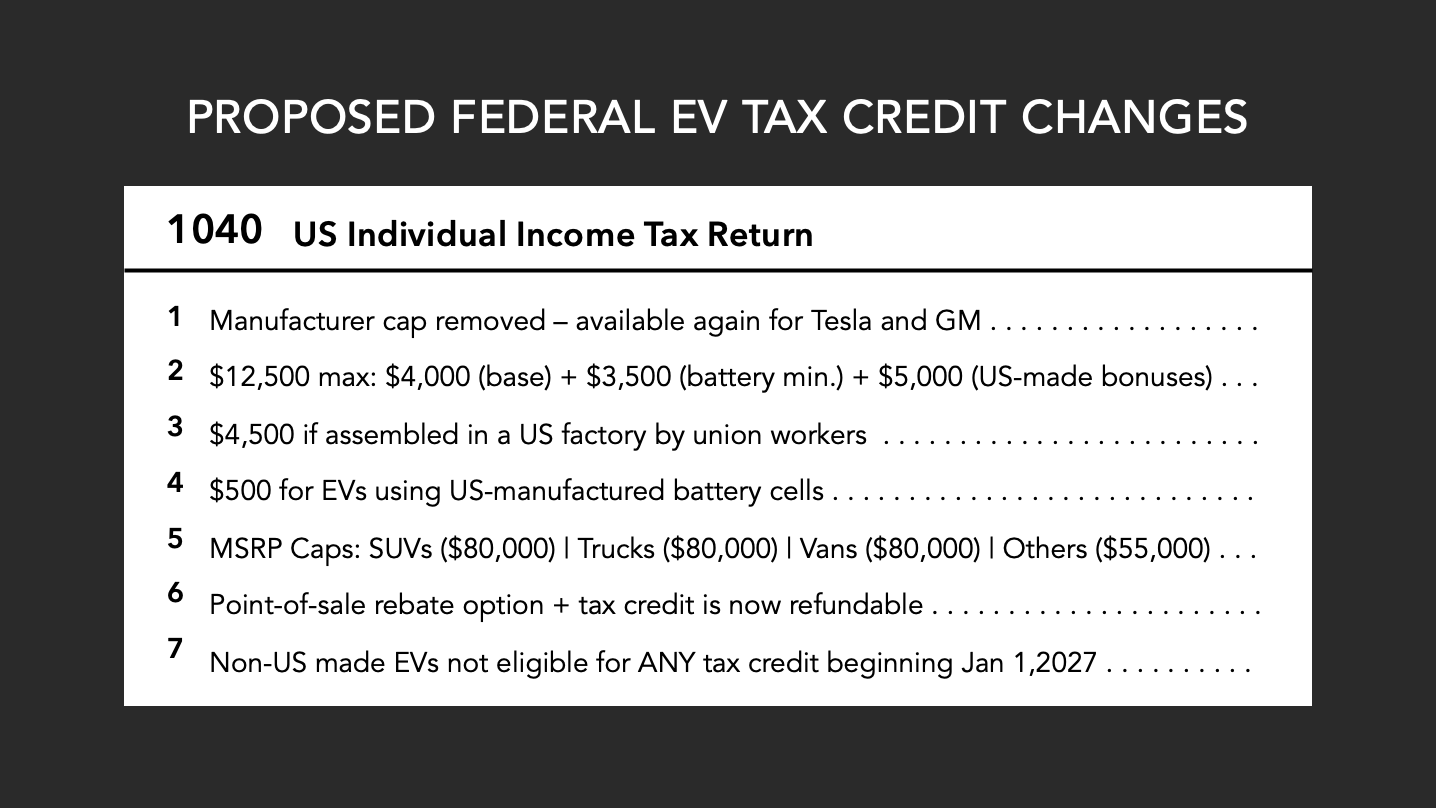

But Rivian has a solution according to the press release. How does the EV tax credit work. Major revisions to the EV tax credit were signed into law as part of the Inflation Reduction Act of 2022.

Currently visits to our service centers are by appointment only. Again we dont know for sure if Rivian will qualify This also allowsblocks half the credit. 2nd 2022 910 am PT FredericLambert Rivian RIVN commented on the new EV federal tax that is expected to be adopted and the American automaker said that it is.

Battery capacity is another area that will help determine how much you claim. Rivian R1T The Rivians are truly fresh and exciting but youll have a tricky time fitting even the least expensive one under the 80000 tax credit price cap for trucks and. No electric vehicles currently.

The EV tax credit can make an electric car more affordable but there are pros cons worth knowing about before buying or leasing an electric car. Electric Vehicle EV tax credit FAQ. 2 days agoThe deal caps the suggested retail price of eligible vehicles at 55000 for new cars and 80000 for pickups and SUVs.

At the federal level the tax credits for. Once the Inflation Reduction Act is officially signed into law electric SUVs and pickup EVs below 80000 qualify for the credit for households making under 300000 per. Fortunately buyers who have a written binding contract to purchase a qualified EV before the Inflation Reduction Act.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a. EV batterys components must be manufactured or assembled in North America 50 beginning in 2023 increasing by 10 each year up to 100 in 2028. Rivians EVs would have qualified for a 7500 federal tax credit under the current system.

On GMs earnings call Tuesday automotive and mobility analyst Colin Langan asked the automakers leader if its electric vehicles will qualify for the full tax credit. R1T 2022 Dual Motor Adventure only 7500. Updated information for consumers as of August 16 2022 New Final Assembly Requirement.

BY Stephen Rivers Posted on August 16 2022 August 16 2022 While theres been a lot of press about the upcoming EV tax credit that could go into law any minute some forget. Rivian is building out a network of service centers to support all Rivian owners. If you are interested in claiming the tax credit available under section 30D EV.

Rivian R1T and R1S too expensive Lucid Air. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. So if Rivian doesnt meet this requirement 3750 of the credit goes away.

When an OEM satisfies the first two requirements buyers. I signed the 100 non refundable agreement document. The Federal Plug-In Electric Drive Vehicle Credit based eligibility on an EVs battery.

EV News Aug 18 2022 Its time to read about some of the most interesting happenings in the EV space this week. Electric vehicles purchased after December 31 2009 can claim a 2500 tax. A Rivian R1T Truck and R1S SUV is parked outside the Allen Company Sun Valley Conference on July 08 2022 in Sun Valley Idaho.

Updated September 2022. Were thinking about getting another EV or hybrid this year. EDV 700 2022 7500.

How Will The Inflation Reduction Act Impact My Eligibility For The Electric Vehicle Ev Federal Tax Credit Support Center Rivian

Ev Tax Credit Breakdown Rivian Changes Pricing On Reservation Holders And More Ev Truck News Youtube

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

If You Want An Ev Buy Now Rivian Fisker And Others Rush To Lock In Ev Tax Credits Before Changes Electrek

Senate Expands Tax Credit For Ev Drivers

Rivian Lucid Tell Reservation Holders To Sign Binding Agreements

/cdn.vox-cdn.com/uploads/chorus_asset/file/23435020/1240401224.jpg)

Rivian Wins 1 5 Billion Tax Incentive Package To Build An Ev Factory In Georgia The Verge

Industry Group Says Most Evs Will No Longer Qualify For Federal Tax Credits Abc News

3 Best Electric Cars Still Eligible For 7 500 Ev Tax Credit

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HWRHKGOCNNJ5LCNSEX5FCMT5IA.jpg)

Ev Maker Rivian Says Its Current Models Will Not Qualify For Tax Breaks Reuters

Rivian Got Disqualified From New Ev Tax Credits Youtube

How Will The Inflation Reduction Act Impact My Eligibility For The Electric Vehicle Ev Federal Tax Credit Support Center Rivian

Why Rivian Calls The New Ev Tax Credit A Rug Pull For Usa S Ev Makers History Computer

Rivian Exec Claims Proposed Ev Tax Legislation Gives Unfair Advantage To Larger Manufacturers

Rivian And Lucid Have A Workaround Allowing Buyers To Qualify For Ev Tax Credit Carscoops

Tesla Gm Could Crush Competition If Electric Car Tax Credit Is Renewed

Rivian Rivn Wins 1 5 Billion In State Incentives For Georgia Plant Bloomberg

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption